What’s the difference between a freehold and leasehold property? These are the two main forms of home ownership and you should understand the difference before buying a property.

Update: In the final days before parliament was dissolved before the General Election on 4 July 2024, the Leasehold and Freehold Reform Bill was passed into law. What does that mean for your leasehold property? Read about it in our article: 'Wash up' round up: Leasehold Reform and Renters Reform

Here we’ll take a look at each way you can legally own a home, along with the pros and cons of buying freehold and leasehold. We’ll guide you through some of the more technical elements and cover some frequently asked questions on the topic.

In this article:

What is freehold? | What is leasehold? | What’s in the lease? | Issues between freeholders and leaseholders | Leasehold length and declining value | Short leaseholds | Extending leases on leasehold properties | Tips for buying a leasehold property | Commonhold – what is it? | Leasehold new-build houses

What is freehold

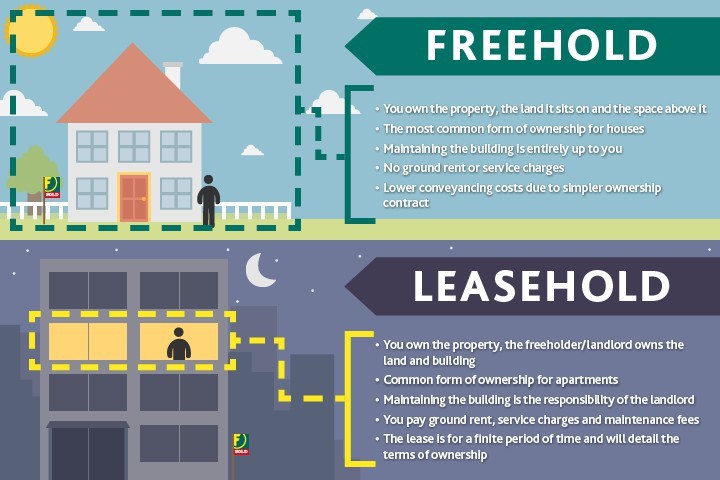

Owning a property freehold means you own it outright: both the building and the land it stands on belong to you. You are registered in the Land Registry as the freeholder, and you own the ‘title absolute’. Freehold is the simpler form of home ownership.

• No annual ground rent to pay or lease to extend

• No relying on a separate freeholder to maintain the building

• Sole responsibility for the maintenance of the building and managing the land rests with you, the freeholder

• Freehold is the most normal way of selling houses as they are standalone properties and include the land they sit on

• Some new-build houses are now being sold leasehold so make sure you check! The government is proposing a ban on this – Click here for more info

What is leasehold?

Leasehold is the more complex of the two forms of home ownership and is common for apartments or in developments, where multiple homes form one larger building on a plot of land.

The freeholder (or landlord) owns the land and building. Homebuyers buy a ‘lease’ for a property from the freeholder. The lease can be of any length – 90 or 120 years are common but can be as much as 999 years. Some mortgage lenders can be averse to lending on a property with fewer years remaining on the lease, so make sure you check with your mortgage advisor if you are unsure how many years need to be left on the lease for the mortgage you have found (more on that here).

Key features of a leasehold:

• A leaseholder buys a lease for a property from the freeholder

• The contract between the leaseholder and freeholder details the legal responsibilities and rights of each party

• The freeholder is usually responsible for the upkeep of the common areas of the building, as well as the roof and exterior walls

• As well as the initial purchase price of the leasehold property, leaseholder will need to pay annual service charges, maintenance fees and a share of insurance for the buildings

• Leaseholders cannot usually undertake any major works on the property without the permission of the freeholder

• Leaseholders may be subject to other restrictions on how they use their property, such as subletting rooms or pet ownership

• The lease can become forfeit if a leaseholder does not fulfil their side of the contract

• Leaseholders can claim the ‘Right to Manage’, which means they can legally take over management of the property from the freeholder (more on that here)

What's in the lease?

The leasehold document contains all the details of the lease, including:

• The length of the lease

• Service charges that will be due

• The amount charged for ground rent (if applicable)

• The obligations of both the freeholder and leaseholder

• Rent increases or changes that are permitted, and when these can happen

Length of the lease: This is often an initial period of 99 or 125 years but can be less if the lease has not been renewed recently. This is usually reflected in the sale price of the property.

Ground rent: The amount of rent the leaseholder must pay to the freeholder. This may be charged monthly or annually, and failure to pay may result in court action and possible extra charges that will be detailed in your leasehold document.

Peppercorn rent: Where ground rent does not exceed “one peppercorn per year,” meaning the freeholder cannot charge ground rent or administration fees.

Obligations: These are the responsibilities of both the freeholder and the leaseholder with regards to the property and the building/common areas.

Rent increases: Details of any increases in the ground rent the leaseholder can expect, showing how much and how often those increases will happen.

SERVICE CHARGES FOR LEASEHOLD PROPERTIES

Most leaseholders will pay service charges to the freeholder or company responsible for managing the property. This covers all the activities that are needed to maintain the building within which the leaseholder’s property sits. Insurance, maintenance, repairs and management are all paid for out of the service charges.

Properties with features such as leisure facilities, concierge services or resident lounges will usually incur higher service charges.

WHAT IS GROUND RENT?

Ground rent is a low fee paid to the freeholder as a token ‘rent’ for the ground a property sits on. For older properties this could amount to around £50-100 paid annually, but for some newer properties it may be higher, and there may be a clause in the leasehold agreement that states how much the ground rent can increase over time. New builds that are being leased for the first time, will not have ground rent.

GROUND RENT INCREASES ON LEASEHOLD PROPERTIES

Buyers should look carefully at any rent increases in the leasehold document. Whilst it is possible your rent could be renegotiated when a lease is extended, once you’ve entered into the lease, your ground rent will increase in line with what is set down there.

Special attention should be paid to ground rents which double after a period of years, often 10, 15 or 20 years. This can become expensive and affect a buyers affordability meaning many banks will not lend on properties which have doubling ground rents.

CONVEYANCING COSTS: FREEHOLD AND LEASEHOLD

Another factor to take into consideration when buying a leasehold property is that, because of the greater complexity of the leasehold contract, conveyancing legal fees are likely to be higher than when buying a freehold property.

Solicitors for both buyer and freeholder will generally need to field a larger number of queries over the process of agreeing the terms and conditions of the leasehold agreement. This generates a much higher conveyancing cost for the buyer.

Issues between freeholders and leaseholders

Some amount of friction is fairly common between leaseholders and freeholders. The following can be a common source of issues if not managed carefully:

Some amount of friction is fairly common between leaseholders and freeholders. The following can be a common source of issues if not managed carefully:

• Maintenance not being completed to residents’ standards is a common cause of complaint against freeholders

• Untidiness in stairwells, landings and outdoor common areas

• Leaseholders often feel that the fees charged by the freeholder are excessive

• Leaseholders might want a statutory lease extension

• Freeholders might complain about leaseholders breaching the terms of their agreement, for example by starting building works without permission

WHAT IS THE RIGHT TO MANAGE?

Right to Manage (RTM) is a way for leaseholders to manage the building, even if the freeholder does not agree to this.

When this occurs, the freeholder still owns the building but the leasehold property owners set up an RTM company, which is responsible for all the management aspects of the building. This includes collecting service charges, maintaining the structure of the building and communal areas, and handling complaints from other leaseholders.

The landlord is able to be a member of the RTM company, with at least one vote on decisions the company makes. Extra votes would be dependent on how many properties the landlord owns within the building.

WHAT IS A SINKING FUND?

A sinking fund is a fund held in reserve to pay for any major or expensive works that might be required on the building. This is not included in all leasehold agreements but many leaseholders will be required to pay into a sinking fund that will be held in case of major works. The freeholder must consult with leaseholders if any work is to be carried out that will cost each leaseholder more than £250.

Leasehold length and declining value

One crucial factor to consider when buying a leasehold property is how the length of lease being offered affects the value of that property.

Once a lease has run out, ownership of a property reverts back to the freeholder. A property with a short lease of, say, 30 years means that unless you extend the lease that property will be owned by the freeholder in 30 years. The costs associated with extending a lease can be significant, so it is essential buyers factor this in if considering buying a property with a shorter lease.

Longer leases of 99 years or more will not depreciate much. A shorter lease of less than 90 years will more rapidly reduce the value of the property over time. The freeholder gradually gains more and more of the value of a property as the end of the lease nears.

Short leaseholds

Buyers considering leasehold properties with leases of less than 80-90 years should be cautious. The reduced value of the property should be reflected in the price, and buyers should look into the costs and feasibility of extending the lease before proceeding with a purchase.

Other problems associated with leasehold properties with shorter leases include reluctance from lenders to provide a mortgage on that property, as well as issues around selling the property on.

Properties with a lease around the 60-year mark start to become very expensive should the leaseholder wish to extend the lease. The cost of this can increase by around 1% of the total value of the property every year.

Extending leases on leasehold properties

It is possible to extend the length of the lease on a leasehold property – indeed, it is a legal right of the leaseholder to do so. However, the costs can be significant, and grow higher as the lease length becomes shorter.

If you own a leasehold property and think you might need to extend your lease, you should carefully consider a number of factors before proceeding and get good legal advice. You need to decide whether it’s worth it, considering how much value the longer lease will add to your property and how much you’ll save with peppercorn rent compared to the cost of the extension.

As the value of a property with a short lease is steadily decreasing, many mortgage providers will be reluctant or unwilling to lend against the value of that property. Legal factors will vary between flats and houses – let’s take a look at the major differences.

EXTENDING LEASES ON FLATS:

• The applicant must have owned the lease on the property for at least two years

• Under normal circumstances the leaseholder has the right to extend their lease by 90 years

• Once a lease has been extended, the leaseholder no longer needs to pay ground rent to the freeholder and can renegotiate the terms of the lease

• A premium must be paid in order to extend the lease

• Once a leaseholder has notified the freeholder that they intend to extend their lease, the freeholder can negotiate, accept or reject the offer

EXTENDING LEASES ON HOUSES:

• The applicant must have owned the lease on the property for at least two years

• Under normal circumstances the leaseholder has the right to extend their lease by 50 years

• Once a lease has been extended, the freeholder can renegotiate the terms of the lease

• Unlike extending freeholds on flats, there is no charge for extending a freehold on a house, although the leaseholder’s ground rent is likely to increase

• Once a leaseholder has notified the freeholder that they intend to extend their lease, the freeholder can negotiate, accept or reject the offer

WHEN SHOULDN’T I EXTEND MY LEASE?

Typically, a property with a lease under 90 years should have its lease extended. However, there are a few scenarios where extending your lease may not be worth the hassle and expense. With costs often spiralling into tens of thousands of pounds, it’s something to be avoided if you can.

You may not want to extend your lease if:

• You are short on cash and unlikely to be able to remortgage

• You’re thinking of moving out of the property in the next year or so

• You’re planning to buy the freehold

• You plan to live in the property for the rest of your life and the lease is long enough for you to do that

Tips for buying a leasehold property

• Be very clear about the length of lease on the property you want to buy

• If the lease is less than 80 years, look into the cost of extending it

• Check communal areas are in good condition and communal electricity bills have been paid

• Make sure you know exactly how much service charges and ground rent will cos

• Check anything in the lease about increases to ground rent or service charges

• Find out if there is a sinking fund to pay into, or any major work that is due to be done on the building

• Check the lease to see whether you are allowed to rent out your property

• Ask for contact details of all relevant parties, including managing agents or the freeholder

PURCHASING THE FREEHOLD FOR A LEASEHOLD PROPERTY

Leaseholders are sometimes able to purchase the freehold of a building to give them more say in how the building is managed and the costs involved.

The leaseholder of a house who buys the freehold then owns both the building and the land it stands on. The leaseholder of a flat can only buy a share of the freehold, along with the other leaseholders.

Buying a share of the freehold requires at least 50% of the leaseholders within the building to agree to each buy a share. Legal advice, as always, is a must. If enough leaseholders agree to buy a share of the freehold, the group must serve notice to the freeholder and set up a group of trustees, or find an agent, to manage the building.

Another way for leaseholders to own the freehold is to set up a commonhold.

Commonhold – what is it?

The commonhold is an alternative to freehold.

• Commonhold means that every owner of each flat or unit within a multi-occupancy building owns the freehold of that flat

• Any communal areas of the building are managed and owned by the Commonhold Association

• The Commonhold Association is a company collectively owned by all the freeholders

• Very few Commonhold Associations have been set up so far in the UK, and as with any collective ownership and management system, issues can arise between members of the association

SHARED FREEHOLDS

A similar system to commonhold, shared freeholds involve all leaseholders jointly owning the freehold. Each owner of a leasehold property within the development or complex owns a share of the freehold, and management of the building as a whole is shared by all the leaseholders.

For the latest on the government's project to make leasehold property ownership fairer, head to the Law Commission's site here.

Buying a freehold or leasehold property? Your local Foxtons agents will help you navigate all the options.